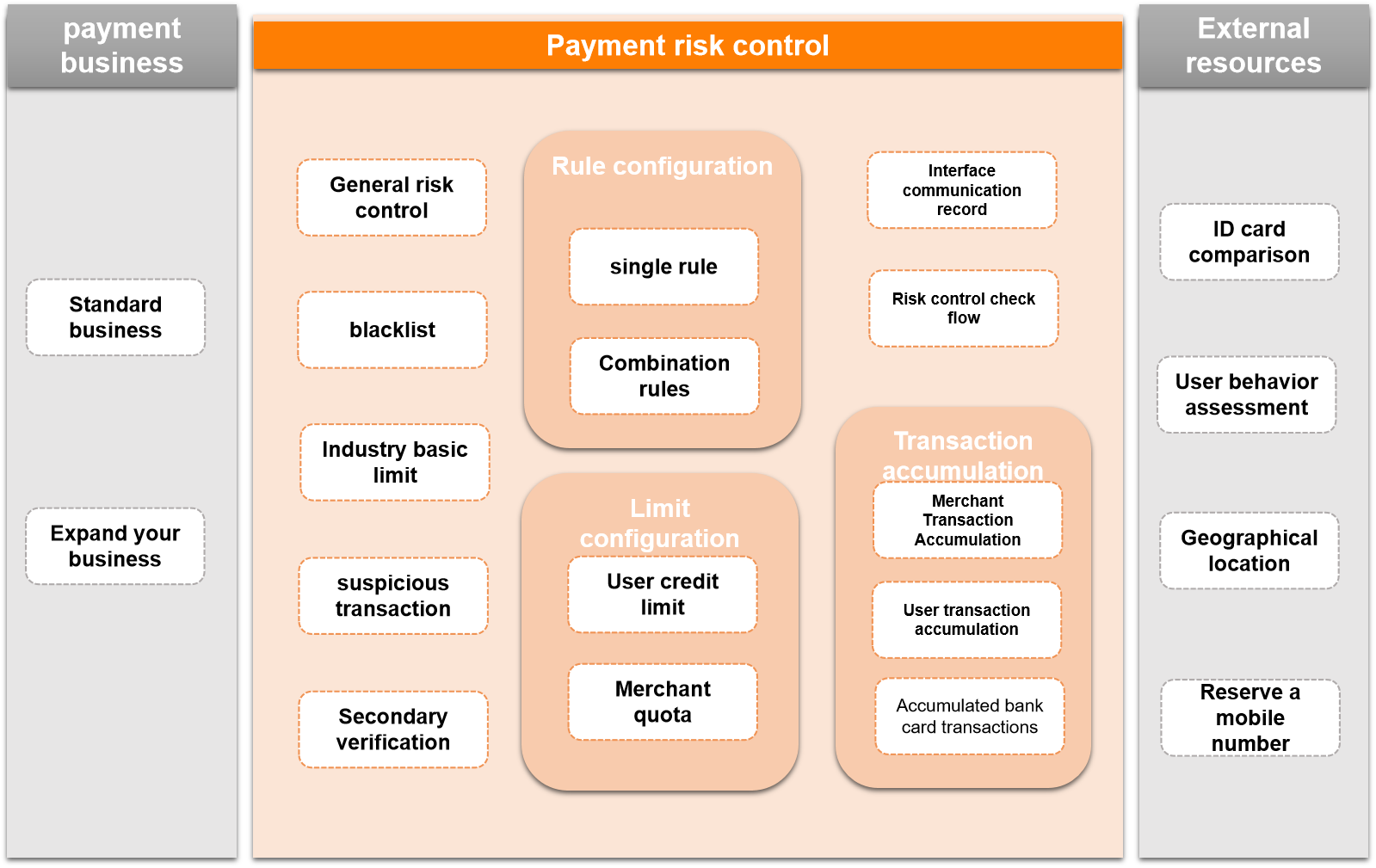

Set up general risk control by industry

According to the payment business, it is subdivided into different industries, and the corresponding industry limit control is carried out, and the merchant industry limit control can be configured first.

Flexible expansion of secondary risk control

For untrusted transactions, do secondary verification and implement corresponding classification rules to improve risk control capabilities. For secondary risk control rules, different rules can be linked together to form a combination of rules. Combine external resources to improve risk control capabilities.

Multi-dimensional blacklist control

Blacklist control is not set by a single blacklist table, but is controlled by a multi-dimensional combination of transaction bank cards, mobile phone numbers, device IDs, and user IDs.

Traceable risk control execution records

For transactions that have been verified by risk control, detailed execution rules are recorded to facilitate analysis of the execution trajectory and the effectiveness of risk control methods.