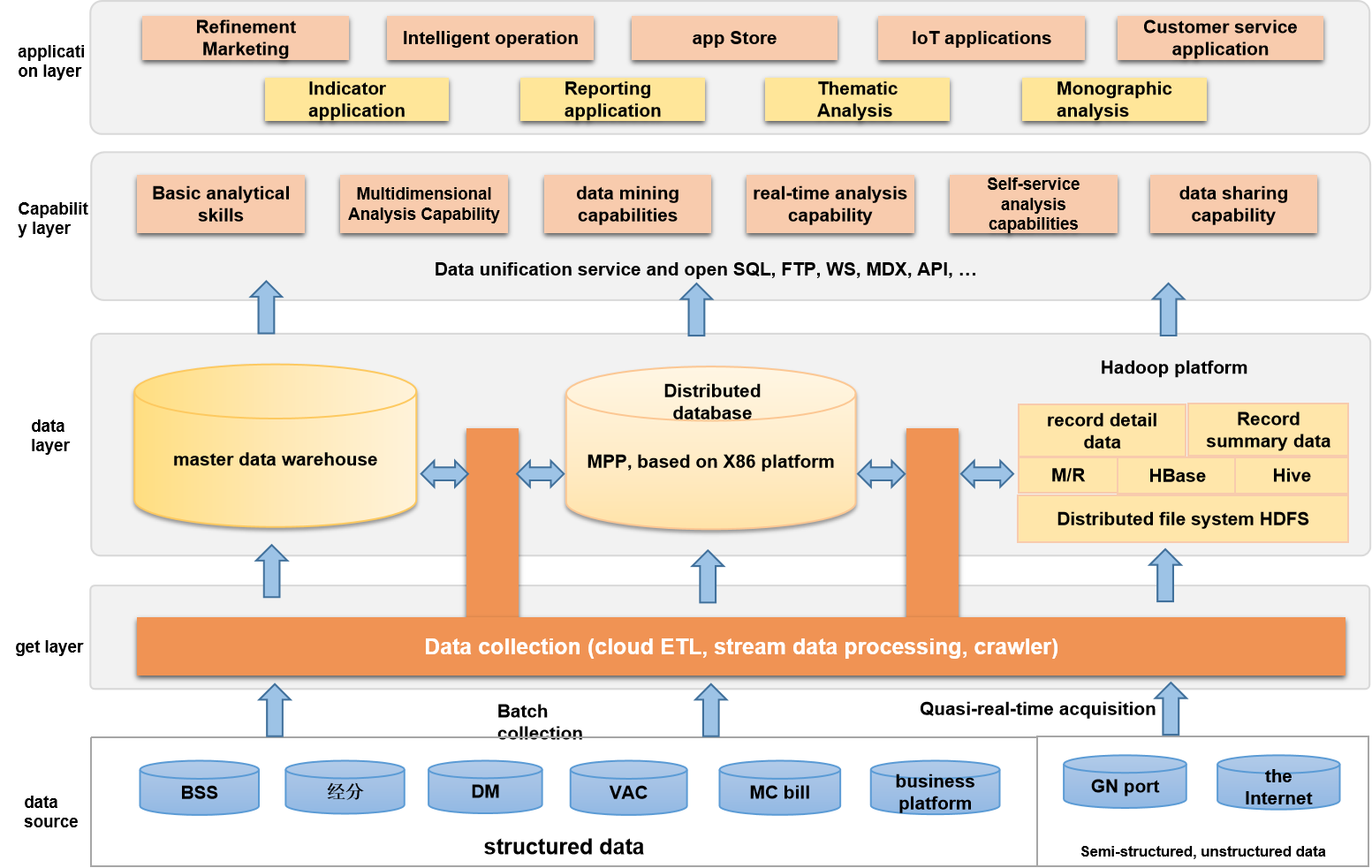

Financial big data platform solutions

In the era of big data, banks are faced with huge business challenges: competitive pressure from multiple parties, poor market performance, rising financial pressure, and increasing difficulty in maintaining customer relationships. In the Internet transaction chain, a variety of mobile payment methods and Internet finance are constantly impacting the business of banks, which makes banks gradually marginalized and pipelined.

Facing a variety of business challenges, with the help of big data technology to integrate multi-party data, banks can develop personalized strategies for digging, robbing, securing and expanding customers through in-depth insights into customers and the market, thereby improving the efficiency of bank marketing and risk control , reduce operating costs, and better enhance customer experience.